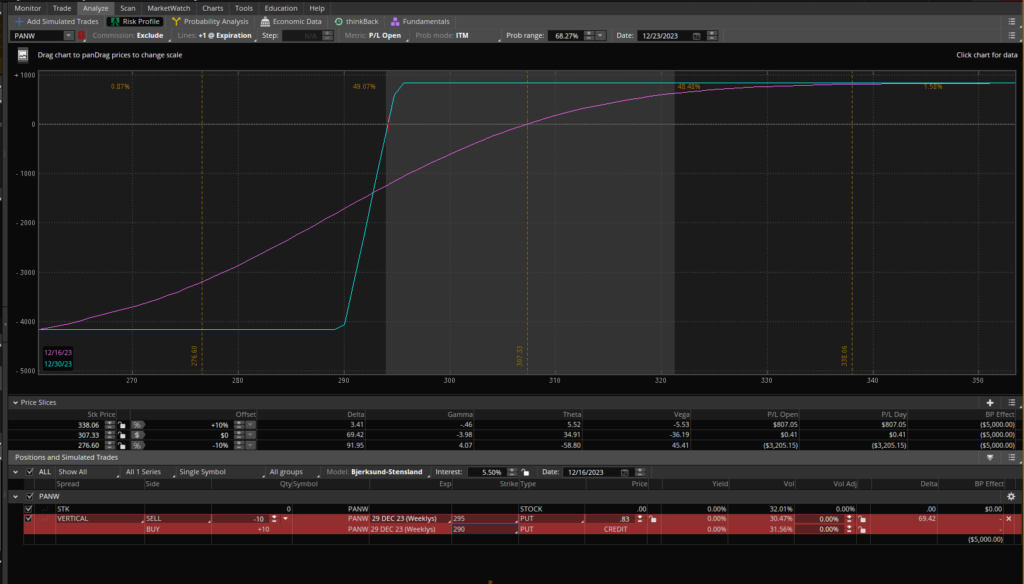

We put on a Bull Put Spread on PANW

| SELL | -10 | TO OPEN | PANW | 29Dec23 (wkly) | 295 | PUT | 2.79 | 1.18 | LMT |

| BUY | 10 | TO OPEN | PANW | 29Dec23 (wkly) | 290 | PUT | 1.61 | CREDIT |

29Dec23 weeklies will expire in 11 days and we do not think prices will go below $295 (currently at $308.20 and no earnings before expiry). So we are selling 10 contracts on a bull put spread, for a total credit of $1.61/contract.

We are looking at a potential full credit of $1180 on $3820 investment, resulting in around 30% approx returns if price does not breach lower threshold of $295.